With the S.A.F.E. Mortgage Licensing Act passing on June 30, 2008, there are a lot of changes expected to happen soon in mortgage BRITISH COLUMBIA FAKE DRIVERS LICENCE. At this time, only about one third of the states are in compliance with the federal law, and since most states are not going to want to hand over their licensing to the federal government, you can expect for many new laws to be passed in the near future. Here are some recent changes to be prepared for.

As of January 1, 2009, LO must be licensed to originate mortgage loans. Prior to that date, Michigan only required Loan Originators to be w-2 employees of a licensed mortgage company. The new law requires the Loan Originator to have either 4.5 years of experience originating loans in the last 5 years or take a 24 hour live education course. Once either experience or education is met, then the Loan Originator is required to take a Michigan Loan Originator Test. The test just became available on October 21, 2008. Loan Originators must then complete fingerprint cards or live scan fingerprinting and go on to the Nationwide Mortgage Licensing System (NMLS) and submit a Loan Originator (MU4) application and then mail all of the previous documentation directly to the state. Everything is currently due to the state by 12/4/08 to guarantee that a Loan Originator License is issued by 1/1/09, however, details on the fingerprinting process has not been released yet, so I expect them to give Loan Originators an extension. Keep in mind, that it is just my opinion, so don’t delay in following the state requirements and meeting the deadlines.

Delaware House Bill 508 becomes effective on January 1, 2009, but mortgage loan originators will not be required to obtain a license until the State Bank Commissioner adopts regulations implementing the new licensing laws. At this time, there is nothing on the states website implementing the Delaware LO Licensing requirement, so it will probably not be required until later in 2009. HB 508 defines a mortgage loan originator as an employee or independent contractor of a licensed Delaware Mortgage Broker or Lender. The legislation requires an MLO to apply to the Office of the State Bank Commissioner for a MLO license, establishes initial and continuing education requirements for licensees, and authorizes the Commissioner to adopt regulations to facilitate participation in the Nationwide Mortgage Licensing System. The bill requires that LO licensees have at least 18 hours of education courses within the five years prior to licensure, or within one year following licensure. Applicants may work as mortgage loan originators upon initial employment on a temporary basis until the person is either licensed or the application is denied. Applicants must submit a $250 investigation fee and a $250 annual license fee.

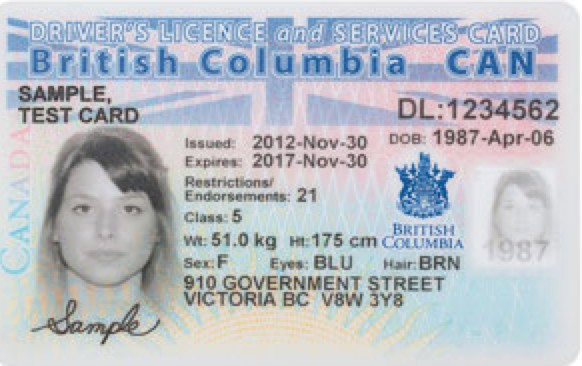

Licensing requirements for Rhode Island Loan Originators are now posted on the Nationwide Mortgage Licensing System (NMLS) website. A Loan Originator license must be obtained by January 1, 2009 in order to continue originating in the state of Rhode Island. The application requires fingerprint cards, 20 hours of pre-licensure education, a personal financial statement showing a positive net worth, a copy of a valid photo ID (for example, driver’s license), and the submission of a Loan Origiantor Application (MU4) on the NMLS. Applications are due by 11/1/08 in order for applications to be approved by 1/1/09. Also, starting in the 2nd quarter of 2009, Rhode Island expects to have a testing requirement.

New states transitioning onto the NMLS on November 1, 2008 are: Arkansas, Indiana, Pennsylvania, and Wyoming. Michigina began transitioning on October 1, 2008. All of these states require transitions to be completed by December 31, 2008. Also, most states already on the NMLS will be using the NMLS for renewals. There are currently 19 states on the NMLS and all states are expected to be on by 2010.

More Stories

What Injuries Do New York Car Accident Doctors Treat? A Comprehensive Overview

MetaMask: The Gateway to the Decentralized Web

The Salt Trick: A Surprising Yet Powerful Solution